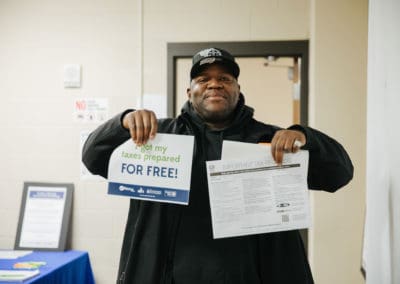

VITA Free Tax Prep

Visit unitedwayfilefree.com to learn more about our free tax prep program, how to get help filing your taxes (virtual or in-person) or to become a VITA volunteer.

Returning Dollars into our Community

The IRS created the Volunteer Income Tax Assistance (VITA) free tax prep program to provide free tax preparation for low-income and at-risk taxpayers with the help of community partners and volunteers. Each year, United Way volunteers help thousands of individuals and families prepare their taxes.

We want to help people keep more of what they earn. Last year, VITA volunteers completed almost 9,000 returns, helping taxpayers save more than $2.7 million in tax preparation fees. The main requirements for becoming a VITA volunteer are time, a willingness to learn and share knowledge with taxpayers and comfort working with computers. Volunteers receive tax training from IRS-trained instructors and can serve in a variety of roles. Many volunteers begin with no prior tax experience. Training and annual certifications are free.

If your household earned less than $70,000 in 2022, you qualify to file your taxes at no cost through our free tax prep program.

What you should know about your taxes:

- Your tax refund may be lower this year if you received unemployment.

- Unemployment benefits are taxable income and must be reported to the IRS.

- Unemployment does not count as earned income for the Earned Income Tax Credit.

- If you are receiving the Earned Income Tax Credit, mailed checks will take longer to arrive.

we’re seeing results

8,000+

Tax returns were completed by volunteers

$11+ Million

In tax refunds were returned back to our community

$2.7 Million

Saved by taxpayers in tax preparation fees